Eddie Bauer files for bankruptcy, begins winding down all stores in the US and Canada

Eddie Bauer LLC, the entity responsible for operating the brand's brick-and-mortar footprint in North America, filed for Chapter 11 bankruptcy protection on February 9, 2026, in the U.S. Bankruptcy Court for the District of New Jersey, marking the end of the brand's century-long presence as a major physical retailer. Going-out-of-business sales have already begun across all 175 locations, which are set to close by April 30 unless a buyer emerges, with the brick-and-mortar operations carrying liabilities of more than $1 billion against assets of just $100 million to $500 million. The filing cites declining sales, supply chain challenges, ongoing inflation, and tariff uncertainty as key drivers, while the brand's e-commerce and wholesale operations — now managed by a separate entity called Outdoor 5 LLC — remain unaffected. The bankruptcy marks the third filing for the storied brand, which was founded in Seattle in 1920, and follows a string of high-profile retail collapses in early 2026 including Saks Global and Francesca's.

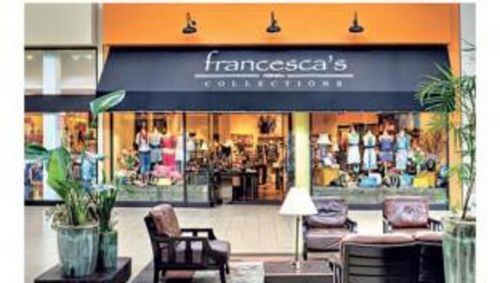

Francesca’s files for bankruptcy; closing all stores

After 25 years of operations, Houston-based women's clothing and accessories chain Francesca's filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the District of New Jersey, with plans to close all approximately 400 stores across 45 states and liquidate. The filing came after a convergence of factors including a 2023 data breach, failed investments in non-core brands, supply chain disruptions after two major suppliers lost their own funding, and the failure of an anticipated capital infusion in December 2025. The company carries about $30.1 million in secured debt, with between $10 million and $50 million in consolidated assets and approximately 1,000 to 5,000 creditors, including landlords Simon Property Group and Tanger Properties listed among its top 30 unsecured creditors. This marks the second bankruptcy filing in six years for Francesca's, which was previously sold out of bankruptcy in January 2021 to an affiliate of private equity firm TerraMar Capital for $18 million.

What to watch in retail in 2026

Retail industry trends for 2026 include continued AI adoption for product research and customer service, value-seeking consumers driving traffic to discount retailers, and shopping malls experiencing a rebound with renewed investment in mixed-use projects. Mall foot traffic increased in 2025, with indoor malls seeing a 1.8% rise in visits and visit durations up 3.3% compared to the first half of 2024, as traditional retail shopping centers transform into destinations for entertainment and experiences. Industry executives remain optimistic, with 96% expecting revenue growth and 81% anticipating margin expansion in 2026, despite challenges including weakened consumer buying power, high interest rates, and competition from mass merchants and value retailers. Specialty retailers face particular vulnerability in 2026 as high interest rates, shifts toward online shopping, and aggressive competition from mass merchants are predicted to push overleveraged companies into bankruptcy.

Bain & Co.: U.S. retail sales to grow 3.5% in 2026

U.S. retail sales are projected to grow 3.5% year-over-year in 2026 to reach $5.3 trillion, slightly down from estimated 4.0% growth in 2025, according to Bain & Company's 2026 Global Retail Sales Outlook. Volume growth will remain modest with inflation projected between 2.6% and 3.0%, as mounting consumer strain and declining confidence affect spending amid economic uncertainty, rising unemployment, and slowing labor supply growth. Bain's Consumer Health Index found that sentiment among higher-income U.S. households, who account for more than half of retail spending, declined in January 2026. The report notes that shoppers increasingly gravitating toward lower-priced and private label goods could create a "flight to value" that tempers nominal sales growth, though reduced taxes, declining fuel prices, and potential interest rate cuts could bolster consumer sentiment and spending power.

Tariffs in 2026: Businesses and consumers face the next wave of costs

Inflation is forecast to rise to 2.7% in 2026 as businesses pass more tariff costs to consumers, up from approximately 2.6% in 2025, with consumption growth expected to ease to 1.9% as households work to rebuild savings rates. The Trump tariffs represent the largest U.S. tax increase as a percentage of GDP since 1993, amounting to an average household tax increase of $1,500 in 2026, with the weighted average applied tariff rate on all imports rising to 15.8%. Goldman Sachs economists estimate that as of August, U.S. businesses were absorbing 51% of tariff costs while American consumers shouldered 37% of the burden, though consumers are projected to absorb 55% by the end of 2025. Manufacturers have expressed that tariffs are hurting consumer demand, pushing up prices, and complicating business planning, with some firms shifting focus from efficiency-improving capital investments to mitigating tariff costs.

Francesca’s to permanently close

Fashion retailer Francesca's is permanently ceasing operations following a progressive wave of store closures and layoffs, with the Houston corporate headquarters closure impacting 202 employees on a rolling basis. The abrupt liquidation was triggered by unpaid vendors allegedly owed $250 million, with employees reportedly laid off without warning and liquidation sales beginning in mid-January 2026. Francesca's, which was founded in Houston in 1999 and peaked at over 600 locations by 2016, filed for Chapter 11 bankruptcy in December 2020 and was sold to TerraMar Capital for $18 million in early 2021. Despite post-bankruptcy revival efforts including launching a tween line called Franki by Francesca's and acquiring lifestyle brand Richer Poorer, the company continued struggling with liquidity issues and financial pressures.

Aldi to open 180-plus stores in 2026, launch new e-commerce site

Discount grocer Aldi plans to open more than 180 new stores across 31 states in 2026, celebrating its 50th anniversary in the U.S. and pushing toward its goal of 3,200 stores by 2028. The expansion includes entering Maine as its 40th state with a Portland location, launching a five-year Colorado expansion plan with 50 stores in Denver and Colorado Springs, and converting close to 80 Southeastern Grocers locations to the Aldi format. Aldi will launch a redesigned website early in 2026 featuring tailored product recommendations for easy reordering, expanded nutritional information, shoppable recipes, and meal planning tools to support both curbside pickup and home delivery. The company plans to open three new distribution centers over the next three years in Baldwin, Florida; Goodyear, Arizona; and Aurora, Colorado, as part of its $9 billion investment through 2028.

Claire's plans tech upgrades despite financial setbacks

Mall jewelry and accessories retailer Claire's is planning technology upgrades for 2026, including more seamless data and application integrations and implementation of a modern point-of-sale platform to enhance customer in-store experiences. In 2025, the company focused on transformation and modernization, achieving technology-related cost reductions including a 48% year-over-year reduction in Microsoft Azure cloud spending through automation and improved governance, while also optimizing Microsoft 365 licensing and accelerating store technology refreshes. Looking ahead to 2026, Claire's plans to upgrade legacy systems, deliver faster data integrations, and implement modern POS platforms, with technology positioned as a growth engine rather than just an enabler. The technology transformation comes as the company works to reduce costs and regain its market footing following financial challenges.